Marginal tax rate calculator

Marginal Tax Rate Calculator. 2020 Marginal Tax Rates Calculator.

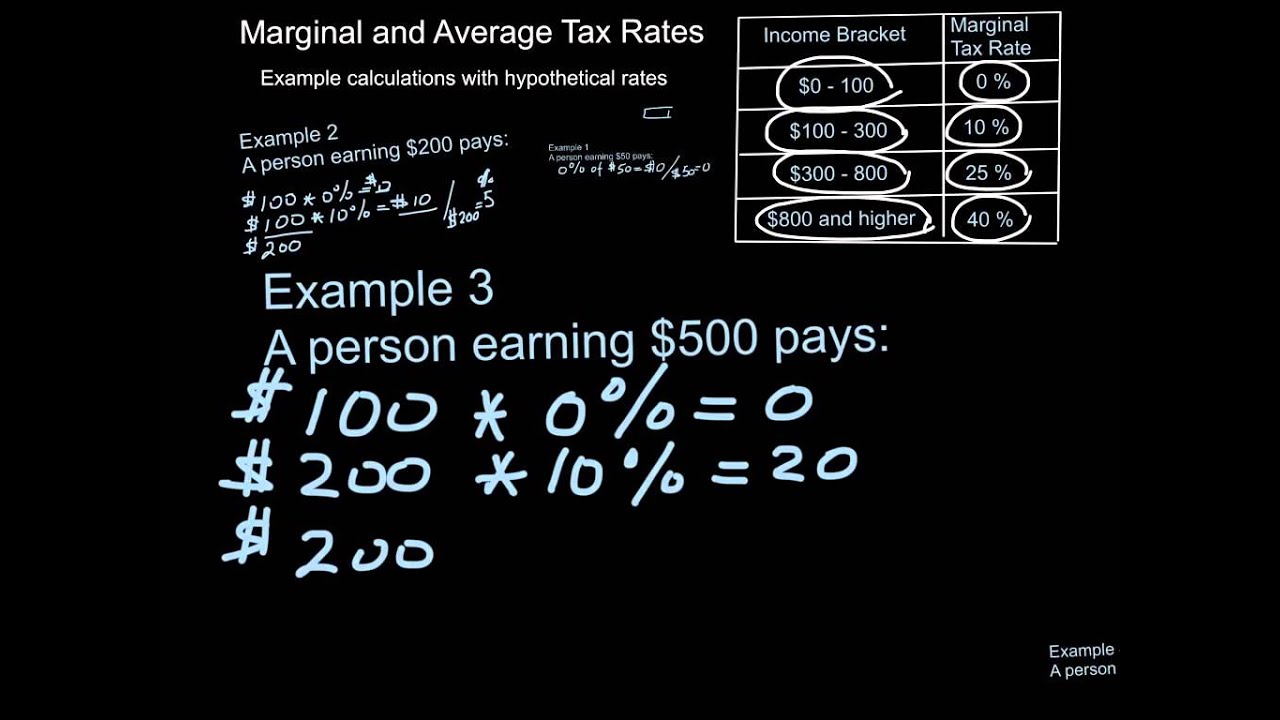

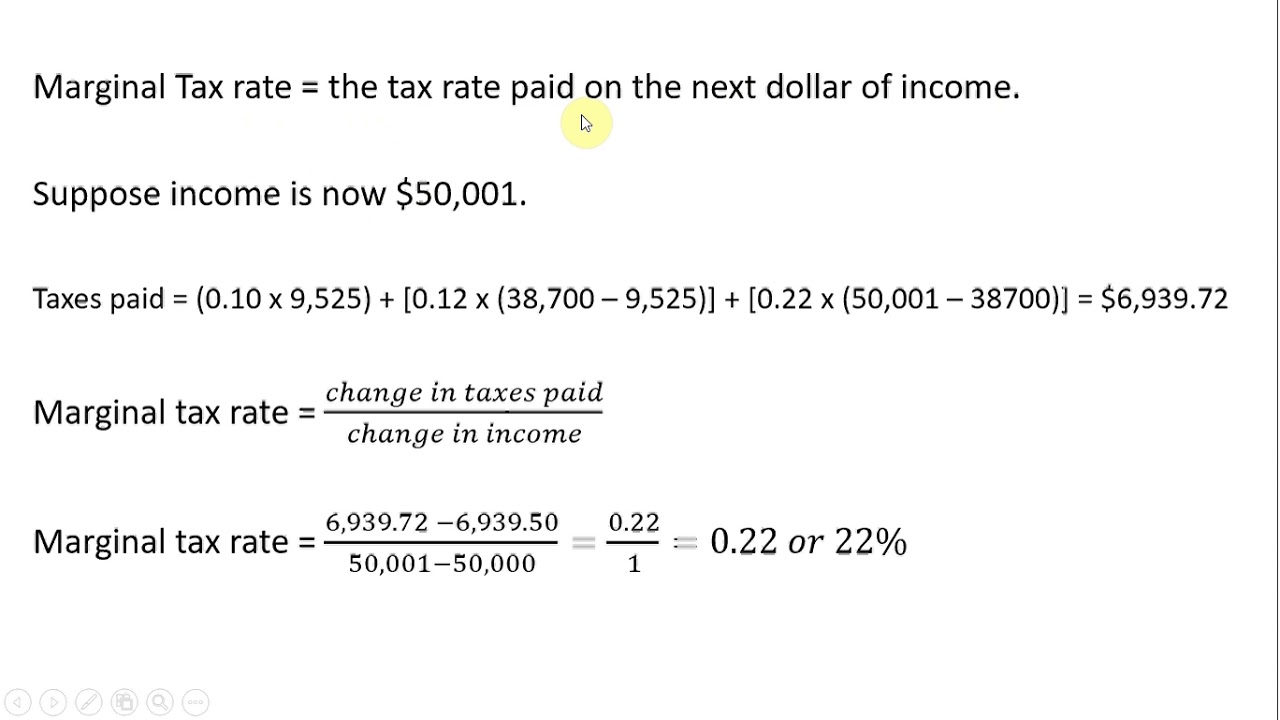

Marginal And Average Tax Rates Example Calculation Youtube

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Marginal Tax Rate Calculator. Marginal Tax Rate Calculator.

Marginal Tax Rate Calculator. Your income within those brackets 13229 and 35791 will be taxed. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Calculate your annual federal and provincial combined tax rate with our easy online tool. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 to 13229 and 13230 - 49020.

Marginal Tax Rate Calculator. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Marginal Tax Rate Calculator for 2022 indicates.

EYs tax calculators and rate tables help simplify the tax process for you by. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Marginal Tax Rate Calculator. Marginal Tax Rate Calculator.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. The rates are for Australian residents. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year.

At 80000 you will also have income in the lower two tax brackets. Your marginal tax rate does not include the Medicare levy which is calculated separately. Marginal Tax Rate Calculator.

This calculator helps you estimate. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

The Medicare levy is calculated as 2 of taxable income for. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

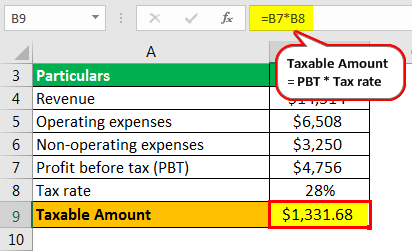

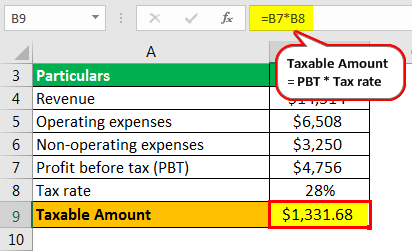

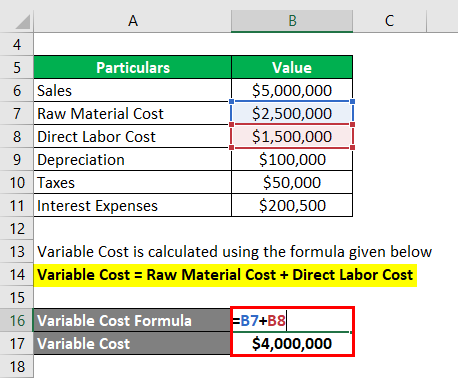

Income Tax Formula Excel University

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxation Calculations Ppt Video Online Download

Equity Multiplier Formula And Calculator Excel Template

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

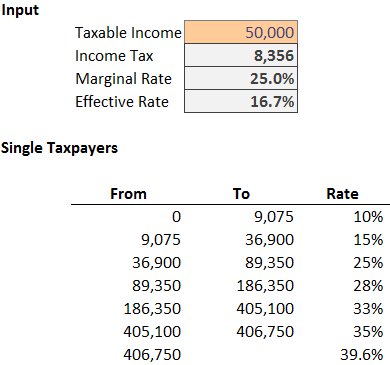

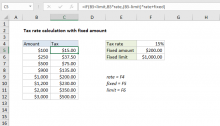

Excel Formula Income Tax Bracket Calculation Exceljet

Break Even Analysis Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Payback Period Formula And Calculator Excel Template

Break Even Sales Formula Calculator Examples With Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

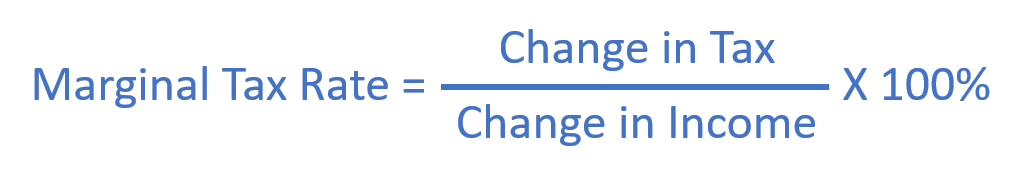

Marginal Tax Rate Formula Definition Investinganswers

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Marginal Tax Rate Bogleheads

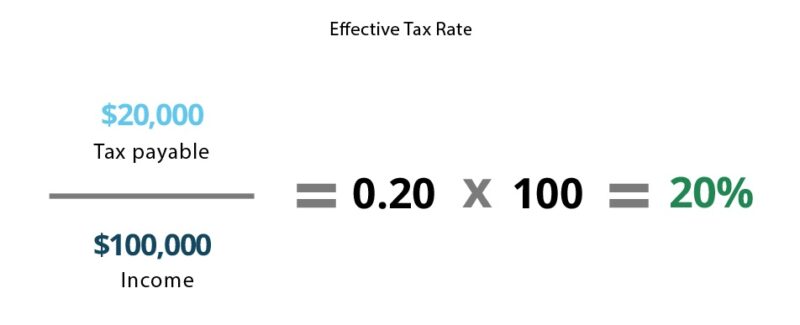

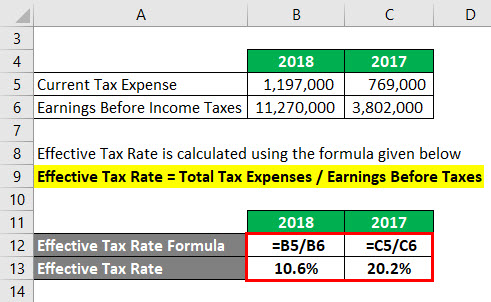

Effective Tax Rate Formula Calculator Excel Template

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law